APY vs. Interest Rate – A Comprehensive Comparison

When it comes to your hard-earned money, every detail matters, especially when considering interest-bearing bank accounts. You’ve likely encountered the terms Annual Percentage Yield (APY) and interest rate, and while they may seem interchangeable at first glance, there’s a significant disparity between the two that could impact your financial decisions.

Let’s dive into the intricacies of APY vs. Interest Rate and unravel the mystery behind compound interest.

Understanding APY vs. Interest Rate

Freepik | The interest rate signifies the rate at which interest accumulates on the original sum.

Interest rate and APY might seem interchangeable, but they play distinct roles in determining how much you earn on your investments or deposits. The interest rate represents the percentage at which interest accrues on the principal amount, while APY encompasses the total interest earned over a year, factoring in compound interest. This compound interest component is the crux of the disparity between the two metrics.

Delving into Compound Interest

Compound interest is the secret sauce that elevates APY to a higher echelon of financial measurement. Unlike a static interest rate, which calculates interest solely on the principal amount, APY takes into account the interest earned on the original balance as well as the interest accumulated over time.

This compounding effect can lead to exponential growth in your savings, making APY a crucial metric for gauging the true earning potential of your accounts.

Why APY Matters More for Savings Accounts

Freepik | Financial institutions must display rates as APY, highlighting the frequency of interests compounding.

When assessing your savings accounts, understanding the APY holds more significance than merely knowing the interest rate. Financial institutions are mandated to display rates as APY, shedding light on the compounded frequency of interest payout. This knowledge offers a more precise insight into the total interest earnings within the year, facilitating informed financial decisions.

Whether you’re eyeing a new savings account or reevaluating existing ones, comprehending the APY ensures you’re equipped with the right tools to maximize your returns.

Comparative Analysis

To elucidate the disparity between APY and interest rate, let’s embark on a comparative analysis.

Imagine you have $10,000 deposited in a bank, earning an interest rate of 4.17% annually, without compounding. In this scenario, the interest earned after one year amounts to $417. However, if we introduce the element of compounding, with interest being deposited proportionally every month, the earning potential amplifies.

As the interest compounds monthly, the total interest earned at the end of the year surpasses the initial projection, thus elevating the effective APY. In this example, while the interest rate remains constant at 4.17%, the APY escalates to approximately 4.25% due to the compounding effect.

Strategies for Maximizing Returns

Freepik | Regularly review your financial portfolio to seize new opportunities and adjust your strategy as market conditions change.

Understanding the nuances between APY vs. Interest Rate opens doors to various strategies for maximizing your financial returns. Consider opting for accounts with higher APYs, as they offer greater potential for growth through compound interest.

Additionally, explore accounts with favorable compounding frequencies, such as monthly or daily, to capitalize on the power of compounding. Regularly reassess your financial portfolio to leverage new opportunities and adjust your strategy in response to changing market conditions.

Making Informed Decisions

More in Investments

-

`

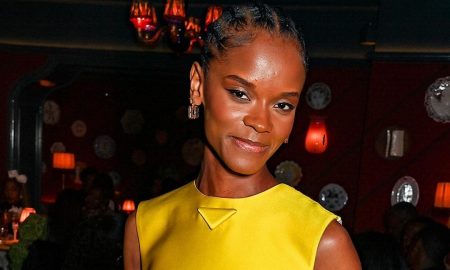

“Black Panther” Star Letitia Wright Wows in ‘Chic’ Mini-Prada Dress at the Blacklisted Dinner

Letitia Wright stunned fashion lovers once again when she attended The Blacklisted Dinner in October 2024 in London. The prestigious event,...

October 29, 2024 -

`

How Will the Business Ownership Information Report Affect Business Operations?

Recently, a significant change has emerged for businesses in the U.S. The Financial Crimes Enforcement Network (FinCEN) has introduced the Business...

October 23, 2024 -

`

Tajikistan’s ‘Strategic Tourism Investment’ Make It One of the Go-to Destinations For Tourists

Strategic tourism is emerging as a powerful force in Tajikistan, driving economic transformation with remarkable potential. With its dramatic landscapes, rich...

October 18, 2024 -

`

Why a Higher Corporate Tax Rate Will Hurt American Consumers and Businesses

The corporate tax rate is a critical factor in the health of the American economy. It influences everything from job creation...

October 9, 2024 -

`

Music Mogul Selena Gomez’s Best Life Lessons for YOU

Don’t Talk About Yourself – Talk About the People You Love One of Selena Gomez’s life hacks is to shift the...

October 1, 2024 -

`

How Small & Medium-Sized Businesses Can Use AI to Grow Exponentially

Artificial Intelligence (AI) is not just for large enterprises. In fact, AI for SMBs is quickly becoming a game-changer, helping small...

September 25, 2024 -

`

Selena Gomez’s Rare Beauty Company Earns Her Billionaire Status

Selena Gomez’s net worth has skyrocketed thanks to her successful makeup line, Rare Beauty. Now in her 30s, she is not...

September 18, 2024 -

`

How to Audition for a Movie the Right Way

Making your way into the film industry can be intimidating, but understanding the audition process is key to success. But how...

September 13, 2024 -

`

What Does B Stock Mean? Understanding B-Stock Products

Have you ever stumbled upon a product labeled “B-Stock” while browsing your favorite online music store? If you’re wondering what B...

September 6, 2024

You must be logged in to post a comment Login