How Will the Business Ownership Information Report Affect Business Operations?

Recently, a significant change has emerged for businesses in the U.S. The Financial Crimes Enforcement Network (FinCEN) has introduced the Business Ownership Information Report, a new requirement designed to enhance transparency and combat financial crimes.

This development requires many small businesses and entities to disclose who owns or controls them, ultimately aiming to strengthen the integrity of the financial system. This initiative, part of the Corporate Transparency Act, will directly affect how companies manage and report their ownership information.

What Is the Business Ownership Information Report?

Pexels | Alexander Suhorucov | The Business Ownership Information Report is a new requirement aimed at improving transparency and addressing financial crimes.

The Business Ownership Information Report serves as a federal mandate for numerous businesses. Specifically, if a company was created or registered before January 1, 2024, it must submit its report by January 1, 2025. This requirement helps the government gather important information about who owns the business, which can reveal risks related to money laundering, tax evasion, and other financial crimes.

Key Components of the Report

The Business Ownership Information Report requires businesses to provide detailed information about their owners. This includes:

1. Names and addresses of individuals who own or control the business.

2. Identification details, such as social security numbers or taxpayer identification numbers.

3. Information regarding any changes in ownership that may occur over time.

By gathering this information, the government aims to create a clearer picture of corporate structures, enhancing its ability to monitor financial activities effectively.

Why Is the Report Necessary?

According to experts, including tax attorney Adam Brewer, the goal of the Business Ownership Information Report is not merely about collecting revenue but about understanding the ownership landscape of corporations and LLCs. “The government is not just looking to impose penalties; it needs to ensure compliance with existing tax laws,” Brewer explained. He emphasizes that this report is separate from income tax returns and serves as an additional tool to verify that businesses are reporting all income accurately.

Potential Consequences of Non-Compliance

Failure to submit the Business Ownership Information Report can lead to significant penalties. Businesses that do not comply may face fines of up to $591 per day. This harsh reality underscores the importance of understanding and adhering to the new reporting requirements.

Who Is Exempt from Filing?

Freepik | andreyoskirko | Brewer clarified that this report is a supplemental tool to verify income accuracy, distinct from income tax returns.

While the requirement applies to a vast number of businesses, there are specific entities that are exempt from filing the Business Ownership Information Report. These exemptions include:

1. Banks and credit unions

2. Certain large operating companies

3. Many nonprofit organizations

By outlining these exemptions, the government aims to minimize the burden on entities that are already subjected to rigorous regulatory scrutiny.

Embracing Change for a Transparent Future

The introduction of the Business Ownership Information Report signifies a pivotal change in how businesses operate within the U.S. This change emphasizes the importance of transparency and the need to fight financial crimes effectively. Companies need to keep up with these changes and comply with the new regulations to avoid penalties.

As businesses adjust to this new environment, grasping the significance of the Business Ownership Information Report becomes essential. This initiative affects how companies handle their ownership details and is crucial for broader financial regulations and accountability. Staying informed and proactive will greatly help businesses navigate these new requirements successfully.

More in Advisor

-

`

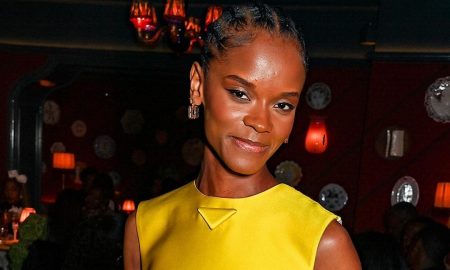

“Black Panther” Star Letitia Wright Wows in ‘Chic’ Mini-Prada Dress at the Blacklisted Dinner

Letitia Wright stunned fashion lovers once again when she attended The Blacklisted Dinner in October 2024 in London. The prestigious event,...

October 29, 2024 -

`

Tajikistan’s ‘Strategic Tourism Investment’ Make It One of the Go-to Destinations For Tourists

Strategic tourism is emerging as a powerful force in Tajikistan, driving economic transformation with remarkable potential. With its dramatic landscapes, rich...

October 18, 2024 -

`

Why a Higher Corporate Tax Rate Will Hurt American Consumers and Businesses

The corporate tax rate is a critical factor in the health of the American economy. It influences everything from job creation...

October 9, 2024 -

`

Music Mogul Selena Gomez’s Best Life Lessons for YOU

Don’t Talk About Yourself – Talk About the People You Love One of Selena Gomez’s life hacks is to shift the...

October 1, 2024 -

`

How Small & Medium-Sized Businesses Can Use AI to Grow Exponentially

Artificial Intelligence (AI) is not just for large enterprises. In fact, AI for SMBs is quickly becoming a game-changer, helping small...

September 25, 2024 -

`

Selena Gomez’s Rare Beauty Company Earns Her Billionaire Status

Selena Gomez’s net worth has skyrocketed thanks to her successful makeup line, Rare Beauty. Now in her 30s, she is not...

September 18, 2024 -

`

How to Audition for a Movie the Right Way

Making your way into the film industry can be intimidating, but understanding the audition process is key to success. But how...

September 13, 2024 -

`

What Does B Stock Mean? Understanding B-Stock Products

Have you ever stumbled upon a product labeled “B-Stock” while browsing your favorite online music store? If you’re wondering what B...

September 6, 2024 -

`

Why Did FedEx Just Lay Off 2,000 Workers?

FedEx, the renowned global delivery service provider, is set to make significant workforce reductions as it grapples with a downturn in...

August 27, 2024

You must be logged in to post a comment Login